Dousing the Flame

Author

Kylar Vierra

Published

Jul 29, 2022

Updated

Sep 20, 2022

The Reset of Utah’s Fiery Hot Real Estate Market

*Source data is from UtahRealEstate.com, which does not include Summit, Iron, or Washington counties.

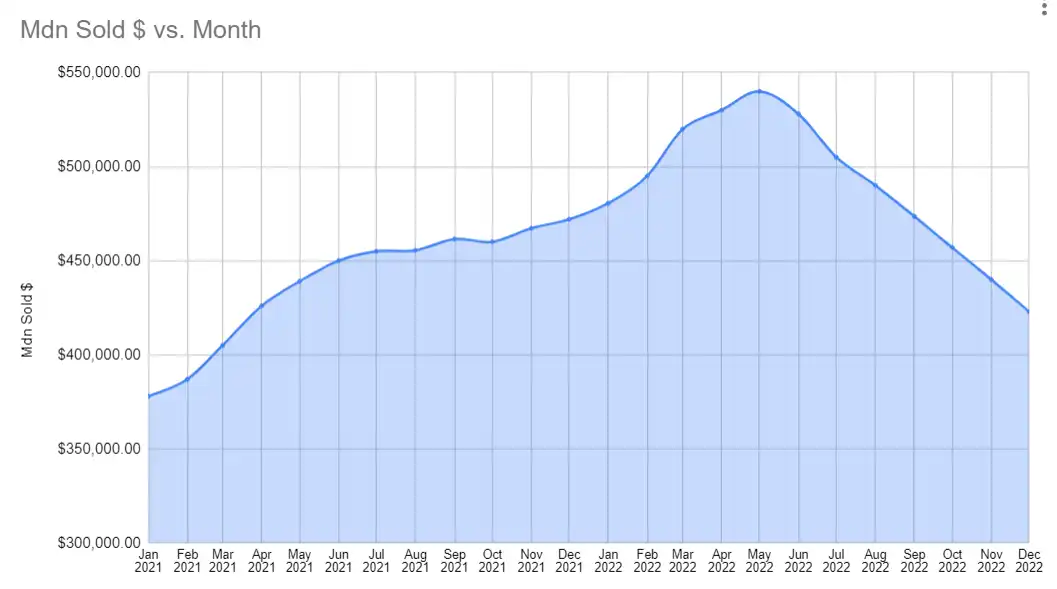

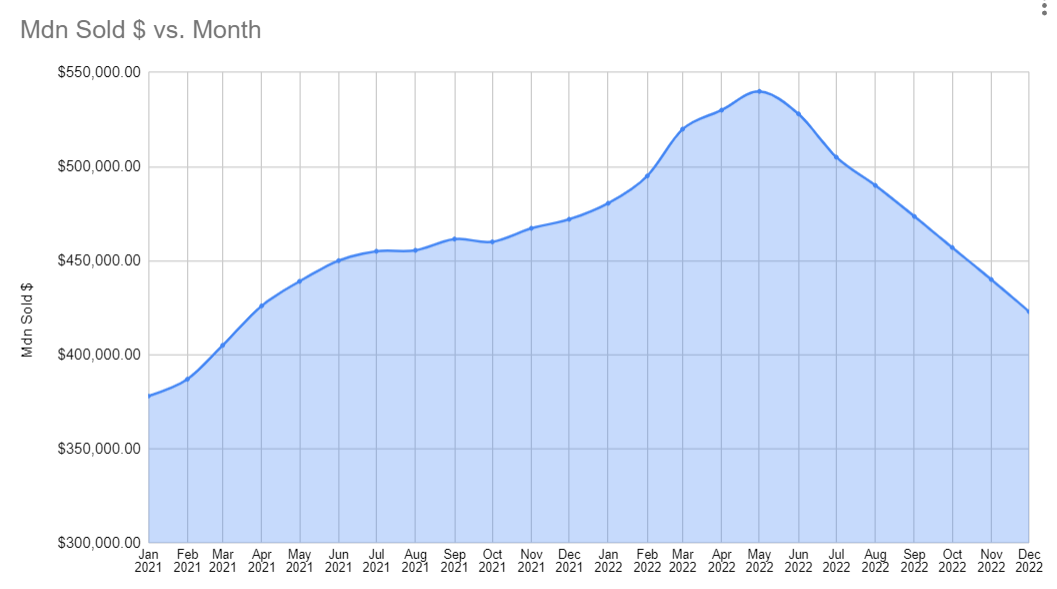

In May, when the market was on fire, median home prices in Utah peaked at $540K and median days on market was 6. June closed at $528K and 9 days on market — a 2.2% decline. July closed at $505K and 15 days on market — a 4.35% decline. Based on properties going under contract today, the median list price of homes is $499K with 19 days on market. Assuming the sale to list ratio is consistent with July (98%), August is projected to close with home prices at $490K — a 3.1% decline. The total difference between May and August’s projected median home price is $50,000 — a 9.2% decline in just three months.

In the six months leading up to May median home prices increased $375 a day. Considering the recent downtrend, home prices are now dropping $550 every day. If this continues, the total dollar decrease from September to December’s close will be $67,100 or a median price of $422K — a 21.7% decrease from May's $540K. Days on market will likely continue to rise leaving December upwards of 30 days. In other words, we’re losing value just as fast as we gained it.

What do these numbers mean? In the short term, it’s fair to expect a few months of declining home prices. The timing of the downturn has lined up with a seasonal lull for Utah. Typically, prices rise during the spring months and plateau into the summer and fall. Winter is sometimes associated with a 1-2% decline, but almost always recovers in the following spring. Right now, we’ve experienced a decline during the first summer month, June, which is irregular by historic standards. With July having closed significantly lower than any other time in the last 20 years, we can expect the fall and winter seasons to at least draw out the downtrend if not amplified by this anomaly.

If the market has a chance of leveling to a point of normalcy it will come in the late winter or early spring of 2023, unless an unexpected event (like falling interest rates, increased money supply, etc.) occurs. The Federal Reserve and the FOMC (Federal Open Market Committee) plan to slow on their recent tightening spree, which will likely pad the current downtrend. However, if inflation continues to rise contrary to the Fed’s expectations, they will be forced to react.

All this is good news for first time home buyers and advocates of affordable housing. Even with higher interest rates a lower down payment can be huge for low-income households. In the market’s transition it’s possible for buyers to negotiate a rate buydown. Unfortunately, sellers are going to have to accept the changing market. While numbers are still exponentially higher than two years ago, it’s not the 30% year over year increase we're used to. Anyone who’s purchased an investment property intending to sell it in the next year will see losses. Their best option is to find a renter for the next four years. If payments are going to bury you, cut your losses and get out.

For buyers and sellers, everything is situational. What do falling home prices mean to you? Make sure to have a professional to help read the smoke signals in this ever changing market.

Similar Articles

Categories

Sorry, nothing matches that search.