Utah Median Home Prices Decline into July

Author

Kylar Vierra

Published

Jul 18, 2022

Updated

Dec 14, 2023

And data suggests August will fall too

*Source data is from UtahRealEstate.com, which does not include Summit, Iron, or Washington counties.

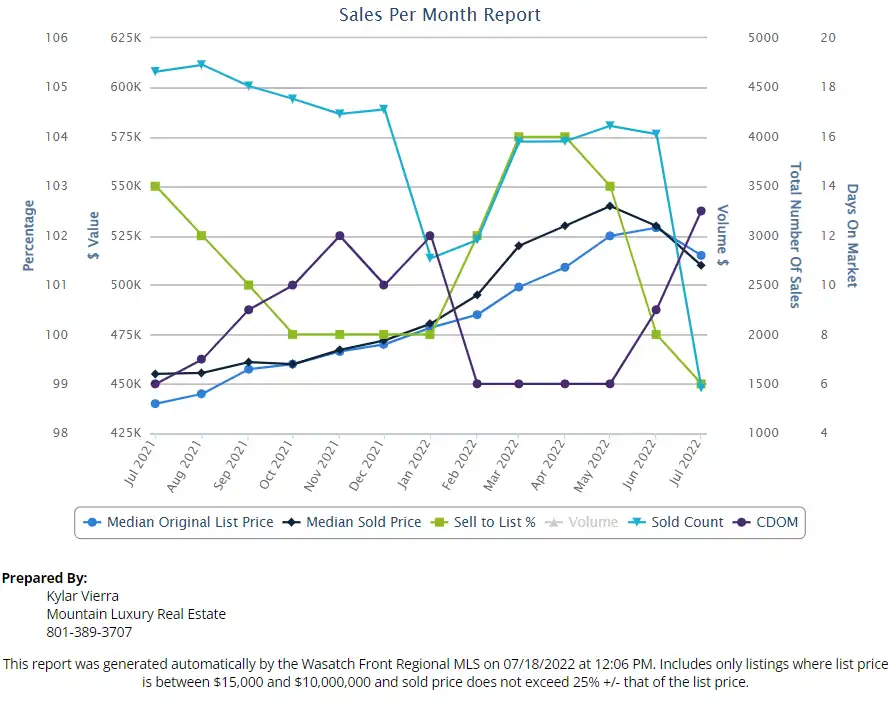

Contrary to many economic reports and realtors’ expectations last year, the median home price in Utah had dropped 2.1% in June. Home purchases went from 103% of list price to 100%. Days on market went from 6 to 9, active properties have more than doubled from this time last year, and properties under contract are dropping fast.

During this same period, Utah had the highest number of active properties experiencing a price reduction at 47%. Those statistics, however, had yet to take effect with the times of REPCs (Real Estate Purchase Contracts) taking about 1 to 2 months to close. Now we’re starting to see the effect of those reductions in July.

As of today, July 18, 2022, the Utah median home price has declined 3.6% from $529,127 in June to $510,000. This is based on 1,425 sales, 41% fewer than this time last month which was 2,432. Sale to list price is 99% currently, down from 100%. As the month draws to a close, it’s safe to say that another monthly decline is around the corner for July.

What’s even more alarming is the trend does not appear to be slowing into August. Today we’re receiving, on average, about 223 price reductions per day. That’s 10.7% more than last month at 199 per day. Remember, REPCs take time to close, so we won’t see the result of these statistics until next month. We can, however, peek into the future by viewing properties that have accepted offers.

There are 1,626 properties UC (Under Contract) in July. The median list price of those homes is $499,999. If we assume the sales will be at 99% of the list price, then the median sale price will be $495,000 — a 2.9% decline. Additionally, the median days on market for those contracts is 18, up from 13 in July.

When comparing this method of analysis to June vs July, the UCs’ stats from June reflect with striking accuracy what we see so far in July. Last month UC properties reflected a $512,900 median price and 13 days on market. July shows $510,000 and 13 days on market. So not only is this month on the decline… August probably is too.

Similar Articles

Categories

Sorry, nothing matches that search.